After reaching an all-time market high on February 19, 2020, US markets began experiencing volatility and fell about 4-5% as of February 24, 2020. To blame is the ongoing outbreak of COVID-19 (Coronavirus), which was first identified in Wuhan, China, but has now spread globally. As of February 24, 2020, China reported over 77,000 confirmed cases. Although the number of new cases in Wuhan peaked on February 17, global markets reacted to news that cases of the virus outside of China have increased, most notably 833 cases in South Korea and Italy reporting 150 new cases over the weekend (Source: Evercore ISI, Bloomberg).

Historical context

In the past, similar outbreaks eventually pass; but the risk to the markets is if the disease spreads much more than anticipated. Expert opinion remains divided on when the Coronavirus will peak as it is more contagious but less deadly than previous viruses. Currently, there are no known vaccines and speculation is it will take about 6-12 months to produce one. The tail risk is the virus spreads outside of China, shutting down production, disrupting supply chains, slowing economic activity, and ultimately weighing on corporate earnings. It’s also unprecedented what happens when a country of 1.4B people quarantines 50M people.

Market data

The consensus among most analysts is any pullback in stocks would be minor (5-7% from highs) and short-lived.

- To date, there have been over 75 negative statements made by companies within the S&P 500 on COVID-19 (source: Evercore ISI). Perhaps the most notable was Apple Inc., who stated they would not meet second-quarter financial targets due to slowed or halted production in China.

- While we would rather have a vaccine than a rate cut, global central banks look to be committed to providing liquidity. For example, last night, the Bank of Japan mentioned they are prepared to act if the situation deteriorates.

- Once again, the yield between the 3-month and 10-year Treasury inverted as longer-term rates fell. Markets are now pricing in two rate cuts by the Federal Reserve before year-end. We are encouraged the spread between the 2- and 10-year Treasurys continues to remain positive, indicating markets still anticipate growth in 2020 (source: Bloomberg).

- The anticipated slowdown in growth and disruption in supply chains is juxtaposed against solid corporate earnings. So far 442 constituent companies of the S&P 500 have reported fourth-quarter earnings with 70.2% beating consensus (source: Evercore ISI).

For now, it appears markets are trading off the headlines, and our base case is the volatility will persist in the short term. Adding to the uncertainty is November’s election, and over the weekend Bernie Sanders solidified his lead in winning the Democratic nomination. As Sanders’ policy views are generally perceived as market negative, many think his win in Nevada is exacerbating market pressure.

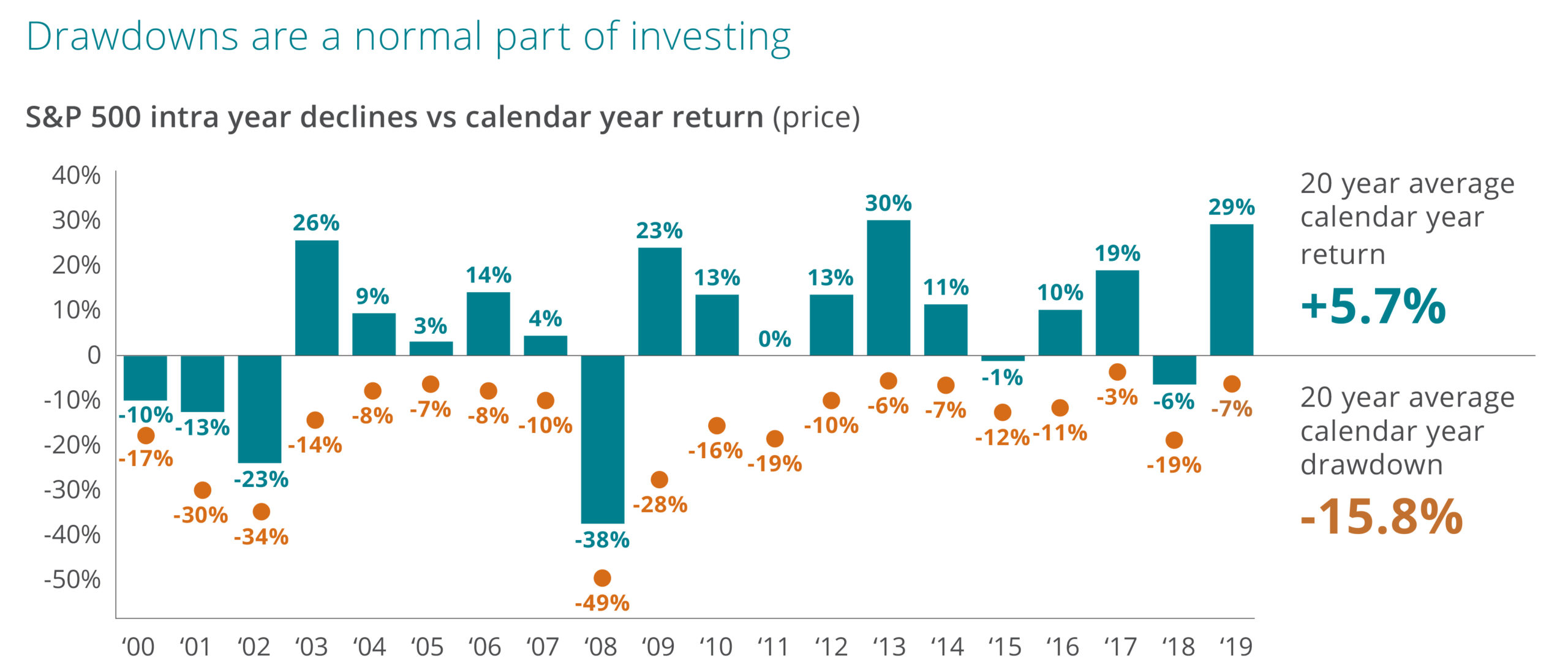

As the chart below shows, drawdowns, while scary, are a normal part of investing. In the last 20 years, there has been a 10% or more drawdown more than half the time. Time and again, investors are better served to maintain a level head in volatile periods than to react. Our intermediate-term outlook remains positive.